Estimate my tax refund

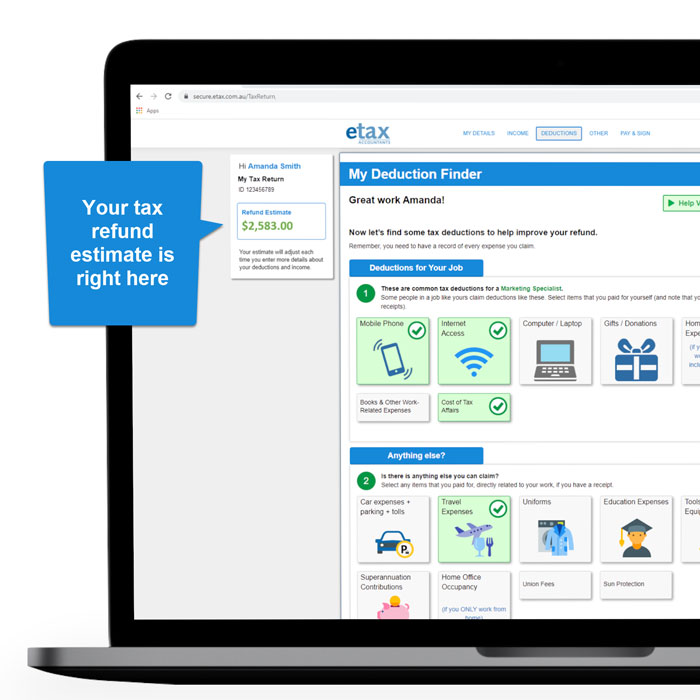

Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits. Learn How Long It Could Take Your 2021 Tax Refund.

H R Block Tax Calculator Free Refund Estimator 2022

It is possible to use W-2 forms as a reference for filling out the input fields.

. Wondering what to expect when you file your taxes this year. 2021 Tax Calculator Exit. Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator.

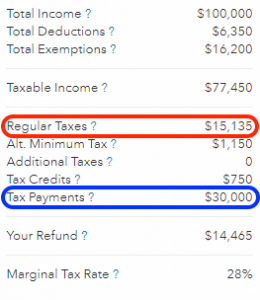

Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc Itemized deductions statelocal and property taxes capped at 10000 - 0 for Standard Amount of gross income considered unearnedinvestment income. The base amount for the 202122 income year has increased to 675 and the full amount is 1500. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

You dont have to be 100 exact. You have to give a reasonable estimate. Taxpayer Bs line 19a amount 18000 is in the 10000 to less than 25000 range in the chart so their payment is 75 of the amount on line 63.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Tax Calculator Refund Estimator for 2022 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income Deductions Other Credits Paid Taxes Results W-4 PRO Estimate Your 2022 Taxes and Refund Before you Prepare and e-File Your 2022 Return Start the 2022 TAXstimator. Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income Deductions Other Credits Paid Taxes Results W-4 PRO Estimate Your 2022 Taxes and Refund Before you Prepare and e-File Your 2021 Return Start the 2022 TAXstimator.

Estimate your federal income tax withholding. A financial advisor can help you understand how taxes fit. The Oregon Tax Estimator Lets You Calculate Your State Taxes For the Tax Year.

If you pay less in estimated taxes you may face an underpayment penalty of 5 of the underpaid amount capped at 25. For example if you underpaid by 2000 you could face a 100 500 penalty. You are eligible for the Middle Class Tax Refund if you.

Estimate Today With The TurboTax Free Calculator. Tax Calculator Refund Estimator for 2023 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income Deductions Other Credits Paid Taxes Results W-4 PRO Estimate Your 2023 Taxes and Refund Before you Prepare and e-File Your 2022 Return Start the 2022 TAXstimator. If your tax situation changes you.

If you applied for an Individual Taxpayer Identification Number ITIN but did not receive it by October 15 2021 you must have filed your complete 2020 tax return by February 15 2021. You can use the worksheet in Form 1040-ES to figure your estimated tax. Estimate Your 2022 Tax Refund.

Enter your income and location to estimate your tax burden. If your taxable income is less than 126000 you will get some or all of the low and middle income tax offset. Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator.

Get Your Tax Refund Date. Income taxes in the US. Ad No More Guessing On Your Tax Refund.

Rest assured that our calculations are up to date with 2021 tax brackets and all tax law changes to give you the most accurate estimate. Are calculated based on tax rates that range from 10 to 37. Up to 10 cash back Estimate your federal tax refund for free today.

Results are as accurate as the information you enter. In order to find an estimated tax refund or due it is first necessary to determine a proper taxable income. Use your income filing status deductions credits to accurately estimate the taxes.

Choose an estimated withholding amount that works for you. Start the TAXstimator Then select your IRS Tax Return Filing Status. Up to 10 cash back Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe.

The offset does not reduce your Medicare levy but it reduces the income tax you pay even down to zero. On Taxpayer Bs return t he line 19a amount is 18000 and the line 63 amount is 333. If you estimated your earnings too high simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter.

Meet the California adjusted gross income CA AGI. 15 Tax Calculators. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

A Simple Step-By-Step Process To Help Guide You Through Calculating Your Taxes. Use your prior years federal tax return as a guide. Tax Calculator Refund Estimator for 2022 IRS Tax Returns Estimated Results 0000 Filing Status Dependents Income Deductions Other Credits Paid Taxes Results W-4 PRO Estimate Your 2022 Taxes and Refund Before you Prepare and e-File Your 2021 Return Start the 2022 TAXstimator.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Relevant W-2 boxes are displayed to the side if they can be taken from the form. Biggest Refund More.

Multiply the amount on line 63 by the percentage you found in the chart above to estimate your payment for this credit. Start the TAXstimator Then select your IRS Tax Return Filing Status. Filed your 2020 tax return by October 15 2021.

Rest assured that our calculations are up to date with 2021 tax brackets and all tax law changes to give you the most accurate estimate. See how your refund take-home pay or tax due are affected by withholding amount. Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe.

2021 View details Basic Info Family Income Deductions. You need to estimate the amount of income you expect to earn for the year. The Federal or IRS Taxes Are Listed.

If you pay more in estimated taxes you will get a refund within six weeks after the IRS accepts your tax return. Step 1 Run Your Numbers in the Tax Refund CalculatorEstimator Answer the simple questions the calculator asks. Enter your information for the year and let us do the rest.

Calculate Your 2023 Tax Refund. Ad See How Long It Could Take Your 2021 Tax Refund.

Irs Notice Cp17 Refund Of Excess Estimated Tax Payments H R Block

Check Your Bank Account You May Have Received Your 2021 Tax Refund

Can I Get A Tax Refund If No Fed Taxes Were Taken Out Of My Paycheck During The Year

Tax Calculator Estimate Your Income Tax For 2022 Free

Tax Calculator Estimate Your Taxes And Refund For Free

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Apply My Tax Refund To Next Year S Taxes H R Block

Tax Return Calculator What S My Tax Refund Estimate

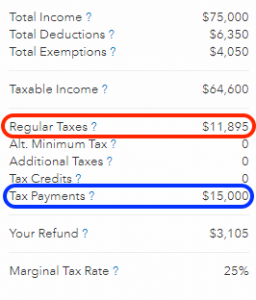

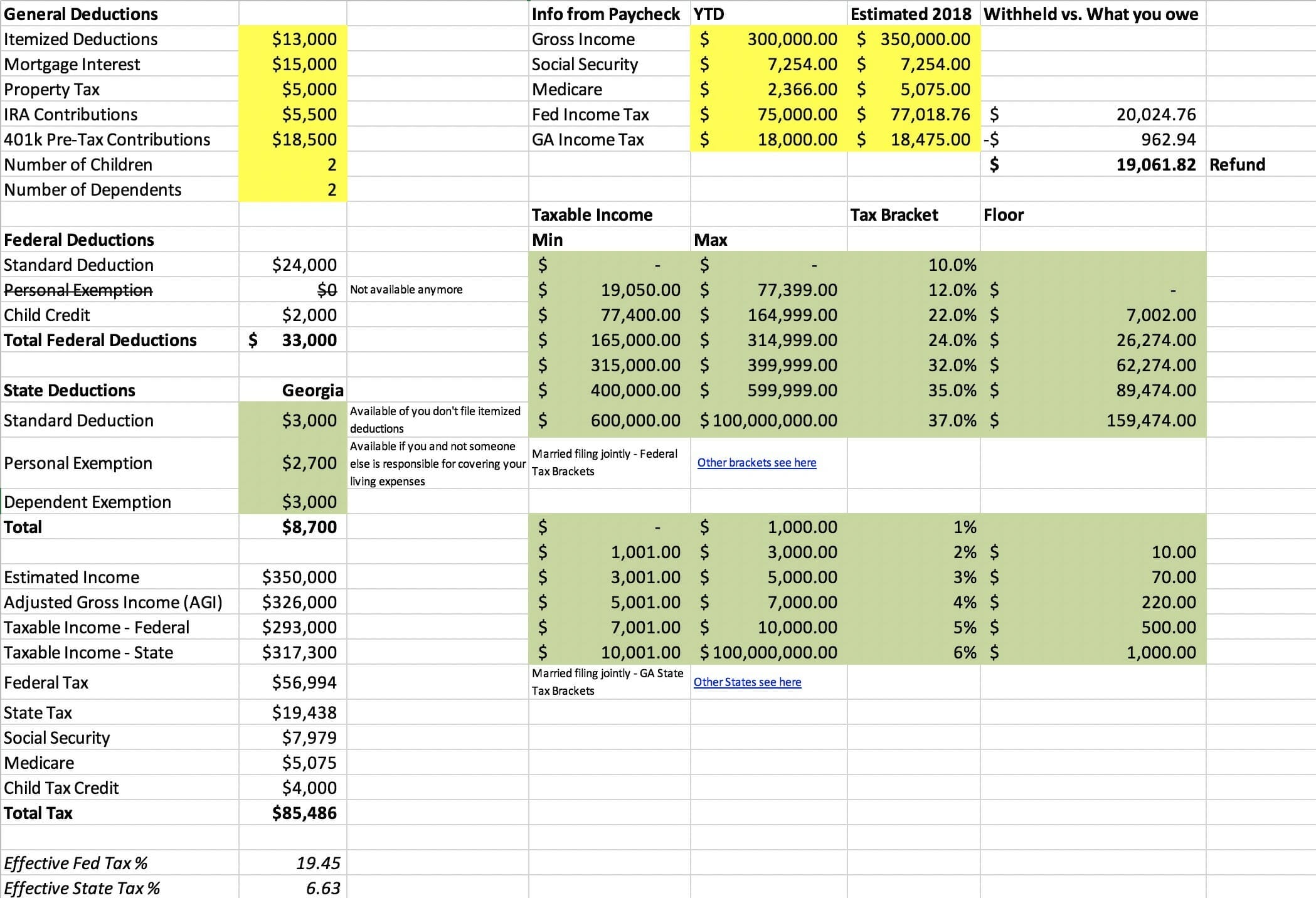

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Cash App Taxes 100 Free Tax Filing For Federal State

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Your Federal Income Tax Liability Personal Finance Series Youtube

Tax Refund Calculator 2020 2021 Tax Return Estimator Industry Super

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

1040 Apply Overpayment To Next Year

Excel Formula Income Tax Bracket Calculation Exceljet